中国恒大集団、米破産法15条の適用申請

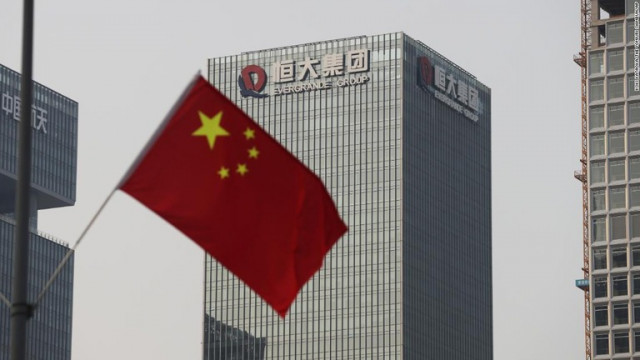

Evergrande Group files for Chapter 15 bankruptcy protection

Evergrande Group files for Chapter 15 bankruptcy protection

恒大は以前、売上高で中国で2番目に大きい不動産開発業者だったが、多額の負債から2021年に債務不履行に陥った

Evergrande, formerly China`s second-largest property developer by revenue, defaulted in 2021 due to heavy debt.

Evergrande, formerly China`s second-largest property developer by revenue, defaulted in 2021 due to heavy debt.

これをきっかけに中国では今も不動産危機が続く

China`s real estate crisis continues

China`s real estate crisis continues

恒大は破産法15条の適用を申請した

Everdai filed for Article 15 of bankruptcy law

Everdai filed for Article 15 of bankruptcy law

これにより米国の裁判所は外国を含む倒産や債務再編の手続きを承認できるようになる

This will allow U.S. courts to approve bankruptcy and debt restructuring proceedings, including foreign ones.

This will allow U.S. courts to approve bankruptcy and debt restructuring proceedings, including foreign ones.

外国の債権者は米国での破産手続きに参加可能となり、外国の債権者に対する差別は禁じられる

Foreign creditors will be able to participate in bankruptcy proceedings in the United States and will be prohibited from discriminating against foreign creditors

Foreign creditors will be able to participate in bankruptcy proceedings in the United States and will be prohibited from discriminating against foreign creditors

恒大は先月、証券取引所への提出書類で、21年と22年に810億ドル(現在の為替レートで約12兆円)の赤字を計上したことを報告した

Evergrande reported in a stock exchange filing last month that it posted losses of $81 billion in 2021 and 2022.

Evergrande reported in a stock exchange filing last month that it posted losses of $81 billion in 2021 and 2022.

恒大の債務総額は昨年末、中国の国内総生産(GDP)の約2%に当たる2兆4370億元(約49兆円)に達した

Evergrande`s total debt reached 2.437 trillion yuan ($49 trillion) at the end of last year, about 2% of China`s gross domestic product (GDP).

Evergrande`s total debt reached 2.437 trillion yuan ($49 trillion) at the end of last year, about 2% of China`s gross domestic product (GDP).

同社は今年3月、国外の債権者に支払いを進めるため、中国で過去最大規模となる債務再編計画を発表していた

The company announced in March the country`s largest-ever debt restructuring plan to make payments to foreign creditors.

The company announced in March the country`s largest-ever debt restructuring plan to make payments to foreign creditors.